A smart way to begin increase a credit rating is to obtain your FICO® Score. Together with the rating itself, you will get a report that spells out the key situations as part of your credit score heritage that happen to be decreasing your rating.

The standard suggestions would be to keep the equilibrium under 30% of one's limit. That’s a superb general guideline and a good round range to commit to memory. But if you can deal with to keep your utilization charge lower than thirty%, that’s better still.

This typically ends in greater interest prices and stricter phrases. Some dealerships may well nevertheless lease for you, however , you might need to offer a larger deposit or conform to bigger every month payments.

To build credit rating, applying for a credit history builder loan might be an acceptable option. Rather than giving you the funds, the money is simply positioned in a personal savings account. As soon as you pay off the loan, you can get entry to The cash additionally any interest accrued.

Using a credit rating score of 487 can be discouraging, however it’s not a long term predicament. By using a identified, phase-by-phase strategy, you can start to rehabilitate your credit standing. Here i will discuss essential steps unique on your rating variety to help you start off:

If you're able to’t afford to pay for a safety deposit, you could be capable of finding an unsecured charge card. The trade-off is that it will most likely feature an once-a-year price — which can be arguably worse than a protection deposit mainly because it’s commonly nonrefundable. You could potentially also encounter better interest charges.

A FICO score of 487 typically indicates a weaker credit history since it destinations larger emphasis on payment background.

Professional-idea: In case you are a sole proprietor or impartial contractor, sign up a private account because you and your company are one and the exact same. For all Other people, you'll be wanting to pick out "Organization Account."

If you can, pay back your statement stability off in total and on time each month so you aren’t charged fascination on Those people purchases.

Let's say I would like to create a late payment? Late Payment penalties vary from lender to lender. Lenders could possibly be forgiving should you Get in touch with them straight, though some might automatically incorporate a payment whether it is in their agreement. To find out more, please Call the lender directly When you've got any problems repaying your loan. What on earth is “Yearly Proportion Fee” – APR? The Once-a-year Share Price (APR) would be the once-a-year fee billed for borrowing and is expressed as a share that represents the particular yearly price of funds around the phrase from the loan.

• Danger of harm: Bear in mind that if the main person mismanages their card, it might negatively affect your score. Your credit is linked get more info to their credit actions.

In case you have derogatory marks like accounts in collections or late payments on your own experiences, they should tumble off your reports in seven many years. Bankruptcies can stay on the reviews for nearly 10 years.

Lenders use credit rating scores to assist evaluate how dangerous they Believe you will end up to lend to. A weak credit rating rating might be an indication which you’ve had some earlier credit history difficulties, like late or discharged payments, accounts in collections or maybe a personal bankruptcy, or you have very little to no credit rating record.

In case you have only one style of credit rating account, broadening your portfolio could assistance your credit score score. Credit history mix is chargeable for as many as ten% of your FICO® Rating.

Devin Ratray Then & Now!

Devin Ratray Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Tyra Banks Then & Now!

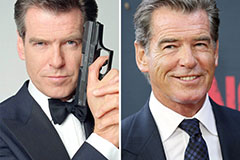

Tyra Banks Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!